Guide to Removing Solana Liquidity

SplkitTech

SplkitTech- 02 Feb 2025

Managing liquidity is a crucial aspect of decentralized finance (DeFi). Whether you are reallocating funds, adjusting your exposure, or responding to changing market conditions, there may come a time when you need to withdraw liquidity. The Solana Liquidity Remover streamlines this process, allowing you to remove LP tokens from your Solana liquidity pools easily. This guide will walk you through the steps to manage your liquidity effectively.

Why Remove Solana Token Liquidity?

There are several strategic reasons why users choose to withdraw their Solana LP tokens:

-

Free Up Capital for New Investments

By removing liquidity, you can free up funds in pools, allowing you to invest in new projects or other opportunities within the Solana ecosystem. -

Adjust Risk and Exposure

Market conditions can fluctuate, and so can your risk tolerance. The Solana Liquidity Remover allows you to reduce your exposure to volatile markets by withdrawing LP tokens when needed. -

Efficient Asset Management

Removing liquidity gives you better control over your capital, whether you are managing SPL tokens, Raydium LP tokens, or other assets. It allows you to adapt your investment strategy as necessary.

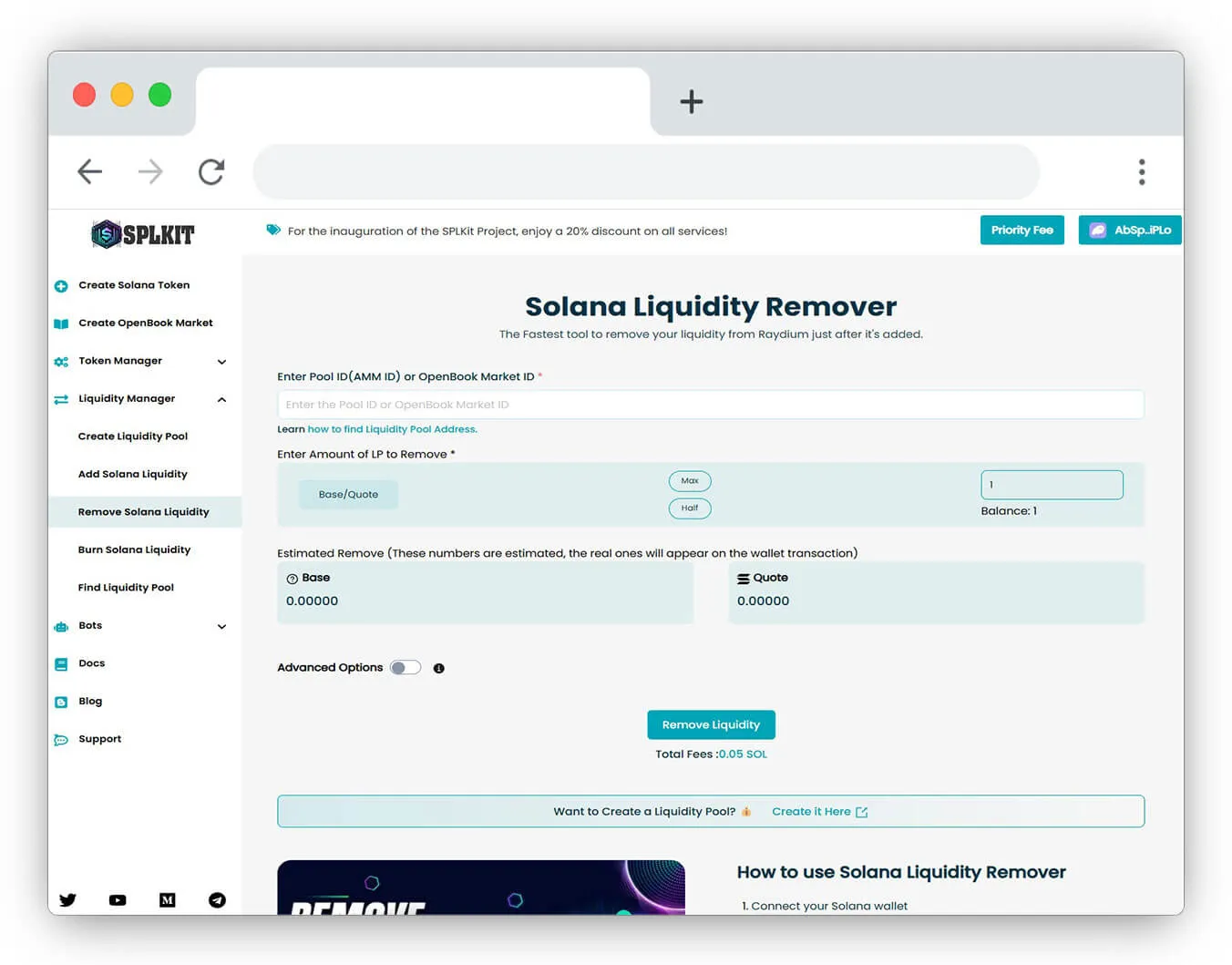

Solana Liquidity Remover Tools

Solana Liquidity Remover Tools

How to Remove Liquidity from Solana Pools

Here is a step-by-step guide on how to remove liquidity from Solana token pools using the Solana Liquidity Remover:

-

Connect Your Solana Wallet

First, connect your Solana-compatible wallet to the platform. This connection is necessary to interact with your liquidity positions. -

Enter the Pool Address (AMM ID)

Find and enter the address (AMM ID) of the liquidity pool from which you wish to withdraw funds. This could be a pool on Raydium or any other Solana-based automated market maker (AMM). -

Specify the Amount of LP Tokens to Withdraw

Enter the amount of liquidity or LP tokens (such as Raydium LP tokens or SPL tokens) you want to remove. This step allows you to retain flexibility regarding how much liquidity you wish to keep in the pool. -

Withdraw Liquidity

Once everything is set, click the "Withdraw Liquidity" button. This will remove your LP tokens from the Solana pool. -

Confirm the Transaction in Your Wallet

Review and approve the transaction in your Solana wallet. Once confirmed, the removed liquidity will be returned to your wallet, and you will have successfully adjusted your liquidity position.

Watch the Solana Liquidity Remover Tutorial

For a detailed walkthrough, watch our video guide on how to remove liquidity from a Solana-based pool.

Considerations Before Removing Liquidity

Before using the Solana Liquidity Remover, it's crucial to keep the following points in mind:

-

Market Impact: Withdrawing large amounts of liquidity can affect market depth and lead to price slippage. Ensure your actions won't negatively impact the liquidity pool or your investment position.

-

Transaction Fees: Be aware that fees may be associated with removing liquidity, particularly on platforms like Raydium. Consider these costs before making your final decision.

-

Liquidity Positioning: Ensure that withdrawing liquidity aligns with your investment strategy. If you plan to re-enter the pool later, remember that market conditions may change, affecting your return on investment.

FAQ: Solana Liquidity Remover

Q1. What is Solana Liquidity Remover?

The Solana Liquidity Remover is a tool designed to help users withdraw their liquidity from pools on the Solana blockchain. Liquidity pools are essential for decentralized exchanges (DEXs) like Raydium and Serum, as they facilitate smooth token swaps and trading. This tool simplifies removing your share of liquidity, enabling you to reclaim your deposited tokens and any accrued rewards. It helps manage your exposure in DeFi, freeing up capital for other investments or adjusting your liquidity strategy on the Solana network.

Q2. Can I remove Raydium LP tokens with the Solana Liquidity Remover?

Yes, the Solana Liquidity Remover supports removing liquidity from Raydium pools and other Solana-based decentralized exchanges that use Automated Market Makers (AMMs).

Q3. What fees are involved when I remove liquidity?

When removing liquidity on Solana, you may incur small network fees (transaction fees) associated with processing the transaction on the blockchain. Additionally, depending on the pool, a withdrawal fee may be specific to the decentralized exchange, such as Raydium.

Q4. How long does it take to remove liquidity?

The Solana Liquidity Remover is designed for speed, allowing you to remove liquidity in seconds. The actual time may vary slightly depending on network congestion, but once the transaction is confirmed, your assets will be promptly returned to your wallet.

Q5. What happens to my rewards when I remove liquidity?

If the pool you participated in provides liquidity rewards (such as token rewards or yield farming incentives), these are typically distributed separately. When you remove liquidity, you will retain the rewards you've earned but stop receiving future rewards from that pool unless you re-enter.

Q6. Does removing liquidity affect market conditions?

Yes, withdrawing large amounts of liquidity can impact the pool's depth, potentially increasing slippage for future traders. It's essential to consider how your withdrawal may affect market stability, particularly in smaller or less liquid pools.

Q7. Can I partially remove liquidity from a pool?

Yes, the Solana Liquidity Remover lets you specify how much liquidity you want to remove. Depending on your investment goals, you can withdraw all or part of your contribution.

Q8. Is there a risk in removing liquidity during market volatility?

During periods of high volatility, the prices of the tokens in the liquidity pool may fluctuate significantly. If you remove liquidity during a downturn, you could receive less value than expected, especially if one of the tokens in the pair has depreciated.

Conclusion

The Solana Liquidity Remover is a user-friendly tool for managing liquidity on the Solana blockchain. Whether you're removing Raydium LP tokens or SPL tokens or simply adjusting your liquidity exposure, this feature is essential for anyone involved in decentralized finance (DeFi). This guide provides clear steps to help you confidently manage your liquidity and make informed decisions that align with your financial goals.