Guide to Adding Liquidity on Solana: Enhance Your DeFi Strategy

SplkitTech

SplkitTech- 03 Jan 2025

In decentralized finance (DeFi), maintaining liquidity in trading pools ensures smooth market activity. The Solana Liquidity Adder simplifies this process, making it easy to add liquidity to your existing pools on the Solana blockchain.". Whether you are a seasoned trader or new to DeFi, this tool offers a streamlined way to inject liquidity into your pools, increasing the availability of your trading assets and helping to stabilize the markets. If you don't have a pool, you can create a Solana liquidity pool first.

Adding liquidity ensures that your trading pairs have sufficient assets available, improving market depth and reducing price volatility. With just a few steps, the Solana Liquidity Adder allows you to specify the amount of liquidity you wish to contribute. This gives you greater control over your investment while enhancing the trading experience for all participants.

Why Add Liquidity on Solana?

Enhance Market Depth

By adding liquidity, you ensure that your trading pairs have sufficient assets available. This reduces slippage and creates a smoother trading experience for users.

Improve Trading Conditions

A well-supplied liquidity pool attracts more traders, allowing trades to be executed efficiently with minimal impact on prices.

Quick Response to Market Changes

The Solana Liquidity Adder enables you to respond swiftly to market demands by injecting additional liquidity, helping stabilize your token’s price.

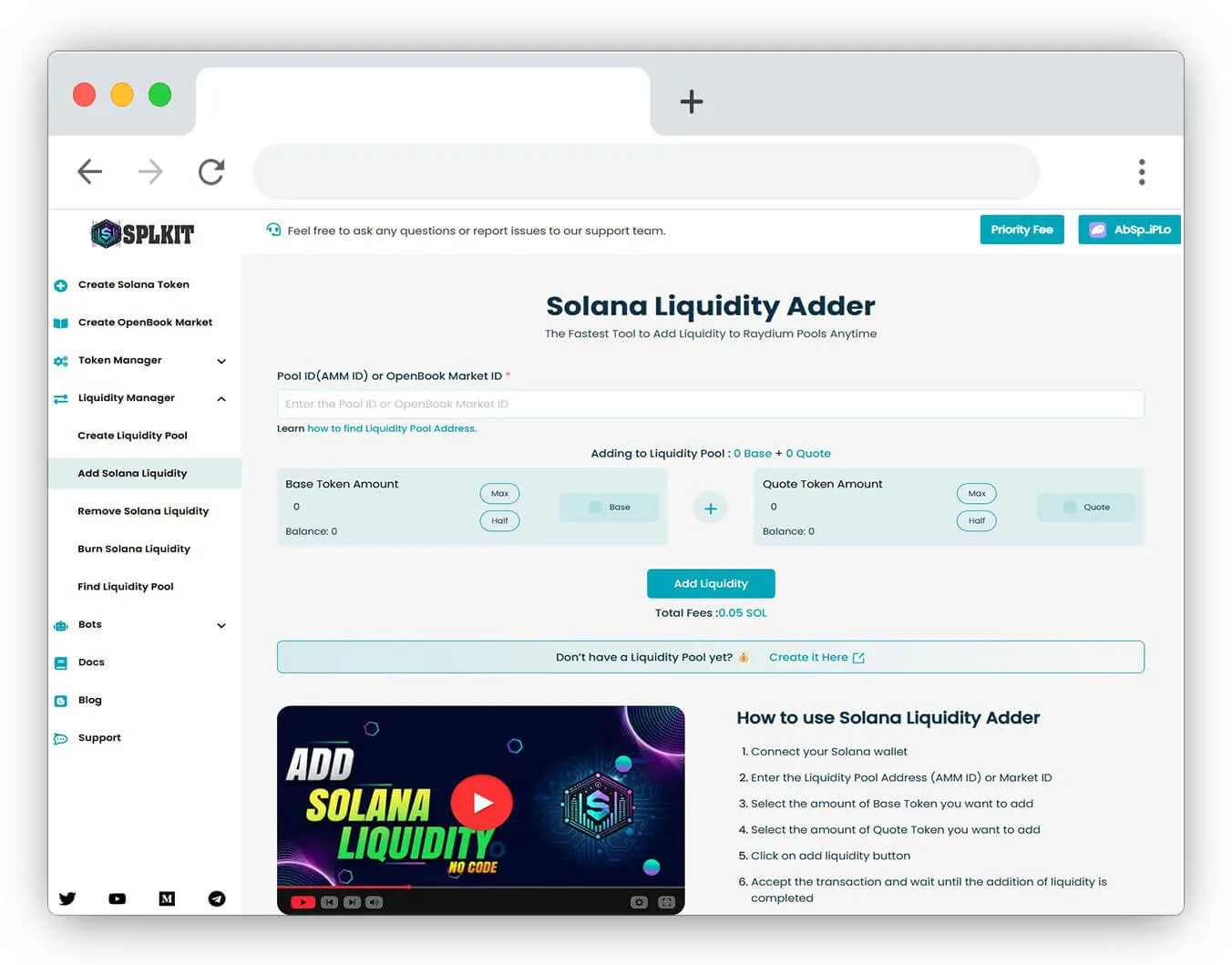

How to Add Liquidity on Solana

Adding liquidity to your Solana pools is a straightforward process. Follow these steps to utilize the Solana Liquidity Adder effectively:

-

Connect Your Solana Wallet: Start by linking your Solana-compatible wallet to the platform. This connection will allow you to interact with your liquidity pools and manage your assets.

-

Input the Liquidity Pool Address: Enter the specific address of the liquidity pool you want to enhance. This address is the AMM ID (Automated Market Maker ID).

-

Choose the Amount of Base Token: Specify the quantity of the Base Token (the primary asset in the pair) you wish to contribute to the liquidity pool.

-

Determine the Amount of Quote Token: Select the amount of the Quote Token (the paired asset) you wish to add alongside the Base Token.

-

Initiate the Liquidity Addition: Click the “Add Liquidity” button to proceed with your contribution.

-

Confirm the Transaction: A confirmation prompt will appear in your Solana wallet. Review the details and approve the transaction. After this step, your liquidity will be successfully added to the pool.

Watch the Tutorial Video

For a comprehensive guide on how to add liquidity on Solana, watch our YouTube tutorial that walks you through the process:

Things to Consider Before Adding Liquidity on Solana

-

Impermanent Loss: When you provide liquidity, there is a risk of impermanent loss. This occurs when the price of the tokens you have pooled changes compared to when you added them. Be aware of this risk when contributing to liquidity pools.

-

Fees and Rewards: By adding liquidity to pools, you can earn a portion of the trading fees or rewards, depending on the platform and specific pool. Make sure the pool you choose offers favorable terms for liquidity providers.

-

Market Stability: The Solana Liquidity Adder enables you to respond to changes in market demand. By adding liquidity, you contribute to stabilizing the trading environment, which can benefit your holdings and the wider market.

FAQ: Solana Liquidity Adder

Q1: What are the risks associated with adding liquidity?

One of the primary risks is impermanent loss, which occurs when the price of the tokens in the pool changes relative to their price when you add them. Additionally, it is essential to consider the fees and rewards associated with different liquidity pools.

Q2: Can I earn rewards for providing liquidity?

Yes, many liquidity pools offer rewards or a portion of trading fees to liquidity providers. Be sure to check the specific terms of the pool you are contributing to, as rewards can vary significantly.

Q3: What costs are involved in adding liquidity?

When adding liquidity, you may incur transaction fees associated with the network and potential fees charged by the liquidity pool. Considering these costs before proceeding is essential, as they can impact your overall returns.

Q4: Is there a tutorial available for using the Solana Liquidity Adder?

A tutorial video guides you through adding liquidity to a Solana-based pool. You can find the video linked in the article.

Q5: How does adding liquidity affect the overall market?

Adding liquidity helps stabilize trading conditions, benefiting your holdings and the broader market. Increased liquidity in a pool can lead to more efficient trading and reduced price volatility.

Q6: What types of tokens can I add liquidity for on Solana?

You can add liquidity for any trading pair available on the Solana blockchain. This typically involves a Base Token and a Quote Token, which you can specify during the liquidity addition process.

Q7: Do I need technical knowledge to use the Solana Liquidity Adder?

No, the Solana Liquidity Adder is designed to be user-friendly and accessible to users of all experience levels. The step-by-step guide and video tutorial provide clear instructions for adding liquidity.

Conclusion

The Solana Liquidity Adder is a vital tool for managing and improving liquidity pools on the Solana blockchain. This feature offers a simple and efficient way to add liquidity, enhance trading conditions, or support the growth of a token ecosystem. Following the steps outlined in this guide, you can confidently contribute to your liquidity pools and help maintain a healthy and vibrant trading environment.