Guide to Burning Solana Liquidity(burn lp on solana)

SplkitTech

SplkitTech- 31 Dec 2024

Effectively managing liquidity on decentralized platforms like Solana is crucial for maintaining a balanced market. One powerful tool is the ability to burn Solana liquidity , permanently removing liquidity from a pool. By burning SOL liquidity provider (LP) tokens or SPL token liquidity, you can reduce the total token supply in circulation. This strategic move can help you manage the supply-demand dynamics of a token, potentially increasing the value of the remaining tokens in the pool.

This guide will walk you through how to burn liquidity on Solana, providing insights into why and when to use this feature as part of your overall liquidity strategy.

Why Burn Solana Liquidity?

Burning liquidity involves more than simply withdrawing your funds from a pool; it can significantly impact the overall market for your tokens. Here are some reasons you might consider burning token liquidity:

-

Influence Token Scarcity

When you burn SOL LP tokens, you reduce the available supply of tokens in the liquidity pool. This can enhance scarcity and potentially increase the value of the remaining tokens in circulation. -

Strategic Liquidity Management

Burning token liquidity allows you to adjust your market exposure and manage risks based on current market conditions. This approach can help you optimize your investment strategy. -

Strengthen Market Position

Reducing your liquidity holdings can strengthen your market position and potentially create more favorable trading conditions for other pool participants.

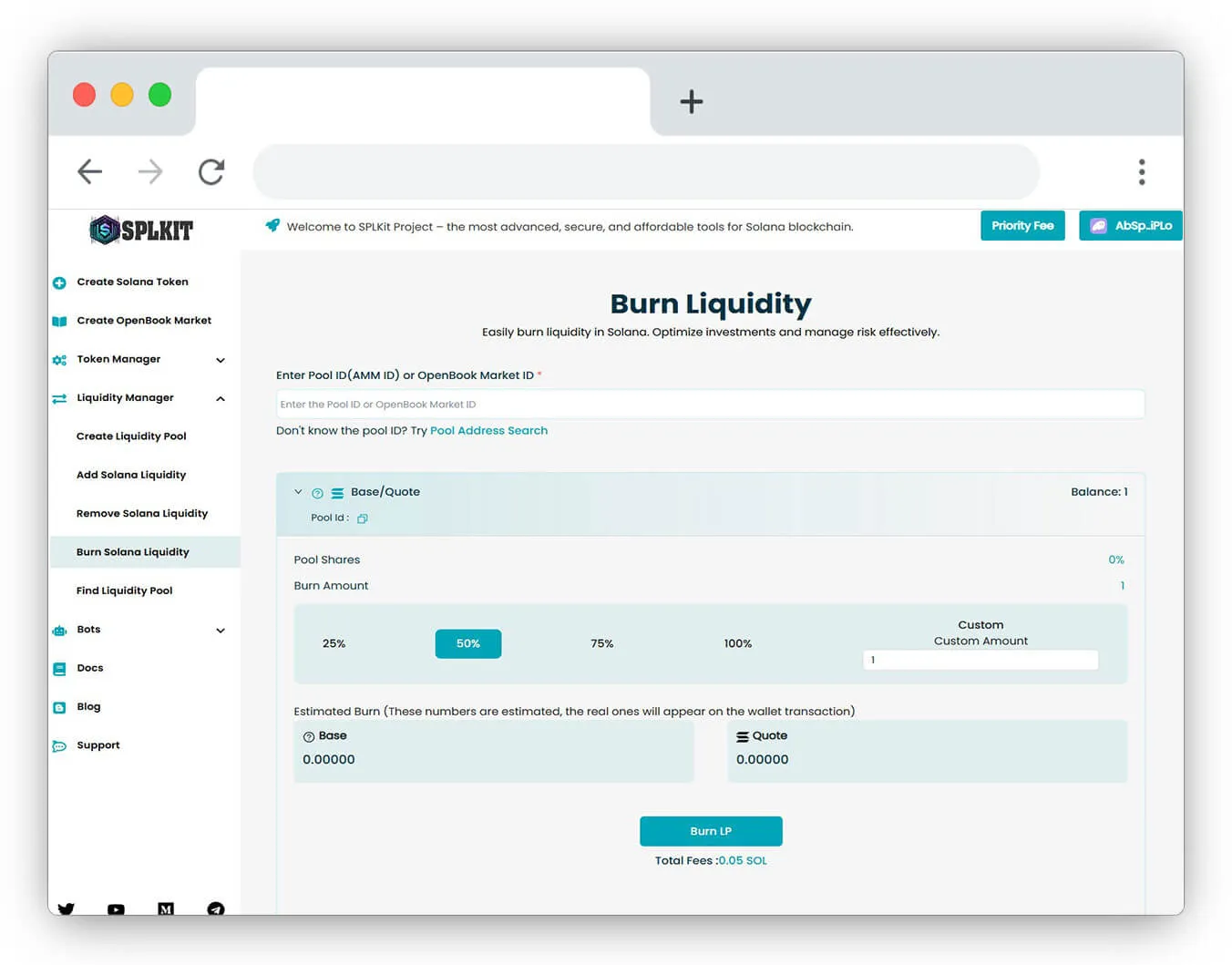

How to Burn Liquidity on Solana

Here's a step-by-step guide on how to burn liquidity on Solana, including the burning of SOL LP tokens and SPL token liquidity from your pools.

1. Connect Your Wallet

Start by connecting your Solana-compatible wallet to the platform.

2. Access the Liquidity Pool

Navigate to the specific liquidity pool where you hold shares. You can either enter the pool's ID or select the associated token. Ensure you interact with the correct pool before initiating the burn process.

3. Check Your Pool Shares

Before proceeding, verify the number of liquidity tokens (LP tokens) you currently hold in the pool. Knowing your holdings is crucial for understanding the burn's impact on the pool's total liquidity.

4. Choose the Amount to Burn

Enter the amount of liquidity you wish to remove from the pool. Whether you are burning SPL token LP or SOL LP tokens, remember that this action is irreversible.

5. Review Estimated Burn Data

Carefully examine the estimated data provided during the process. Burning token liquidity cannot be undone, so ensure this aligns with your overall liquidity management strategy.

6. Submit the Transaction On-Chain

Once you are satisfied with the details, submit the burn transaction on-chain. After confirmation, the liquidity tokens will be permanently burned, reducing the total supply in the pool.

Video Tutorial: How to Burn Liquidity on Solana

For a visual guide on burning liquidity on Solana, including SOL LP tokens and SPL token liquidity, check out our detailed step-by-step video tutorial:

Important Considerations When Burning Liquidity

Irreversibility

Burning SOL LP tokens or any SPL token liquidity is a permanent action. Make sure this decision aligns with your overall liquidity and investment strategy.

Impact on Liquidity Pool

Burning token liquidity reduces the total amount of liquidity available in the pool. This reduction can affect market dynamics, potentially leading to decreased trade liquidity and increased price volatility.

Strategic Timing

The timing of when you burn liquidity on Solana is crucial. Consider current market conditions and liquidity levels before making your decision, as burning liquidity can significantly influence supply and demand dynamics.

FAQ: Burning Liquidity on Solana

Q1. What does it mean to burn liquidity on Solana?

Burning liquidity on the Solana blockchain refers to permanently removing liquidity from a pool. When liquidity tokens, representing your share of the pool, are destroyed, the total supply of tokens available in the pool is reduced.

Q2. What is the difference between burning SOL LP tokens and SPL token liquidity?

SOL LP tokens represent liquidity in pools involving SOL, while SPL token liquidity refers to liquidity in pools involving SPL tokens (Solana Program Library tokens). Burning both types of tokens is similar and involves removing liquidity from a pool.

Q3. Can I reverse the liquidity burn process?

No, once liquidity is burned, it cannot be undone. The tokens are permanently removed from the pool, so it's essential to carefully consider this decision before proceeding.

Q4. How does burning liquidity affect the pool?

Burning liquidity decreases the total supply of tokens in the pool. This reduction can lead to less liquidity for trading, potentially increasing price volatility. Additionally, it reduces your share in the pool, so this action should align with your overall liquidity strategy.

Q5. What should I consider before burning liquidity on Solana?

Before burning liquidity, ensure that your decision aligns with your investment strategy and the current market conditions. Since the process is irreversible, the timing and quantity of liquidity burned can significantly impact the market and your holdings.

Q6. How can burning liquidity impact token prices?

Burning liquidity may create token scarcity by reducing the available supply of tokens in the liquidity pool. If demand remains steady or increases, this could lead to higher token prices due to the reduced supply.

Q7. Do I need to pay any fees to burn liquidity on Solana?

Burning liquidity on Solana typically requires you to pay a small transaction fee (in SOL) to process the transaction on-chain. This fee covers the cost of submitting the transaction to the Solana blockchain.

Q8. Can I burn some of my liquidity, or must I burn it all at once?

You can choose the amount of liquidity to burn; you are not required to burn all your liquidity tokens simultaneously. This flexibility allows you to tailor the burn process to your specific liquidity management strategy.

Conclusion

The Solana Liquidity Pool Burn feature allows you to manage the supply of liquidity tokens in circulation. This guide explains how to burn liquidity on Solana, enabling you to reduce your holdings in a pool strategically. By doing so, you can influence token values and market conditions.

Whether you are burning SOL LP tokens or SPL token liquidity, this process empowers you to refine your market position and adopt a proactive approach to liquidity management. Burning liquidity is a vital tool for anyone looking to control their token supply on Solana. Make informed, well-timed decisions to optimize your investment strategy.