Guide to Creating a Solana Liquidity Pool

SplkitTech

SplkitTech- 03 Jan 2025

Creating a Solana Liquidity Pool is crucial to the Solana blockchain's decentralized finance (DeFi). These liquidity pools allow users to provide liquidity by depositing pairs of tokens into a smart contract, facilitating seamless trading for decentralized exchanges (DEXs) and other DeFi applications. By contributing to a liquidity pool, users help reduce slippage and enhance the overall trading experience by ensuring sufficient tokens are available for swaps. In return for their contributions, liquidity providers earn transaction fees from trades executed within the pool. Solana's fast and low-cost blockchain makes it an attractive option for users looking to engage with DeFi. It offers a scalable and efficient means to support the ecosystem while earning rewards. Whether you are a trader, token creator, or project developer, liquidity pools are a powerful tool for improving market stability and fostering growth within the Solana DeFi space.

Why Create a Solana Liquidity Pool?

Creating a Solana Liquidity Pool is a strategic decision for anyone interested in participating in decentralized finance (DeFi). By establishing a liquidity pool, you facilitate seamless trading on decentralized exchanges (DEXs) and other DeFi applications, contributing to the overall health and efficiency of the ecosystem.

Liquidity pools help reduce slippage and provide market depth, ensuring smoother user transactions. Additionally, liquidity providers can earn passive income from transaction fees on trades executed within the pool, making it profitable to utilize your token holdings.

Solana’s high-speed and low-cost blockchain further enhances these advantages, positioning liquidity pools as a vital component for projects and traders aiming to maximize their impact and returns in the rapidly growing DeFi landscape.

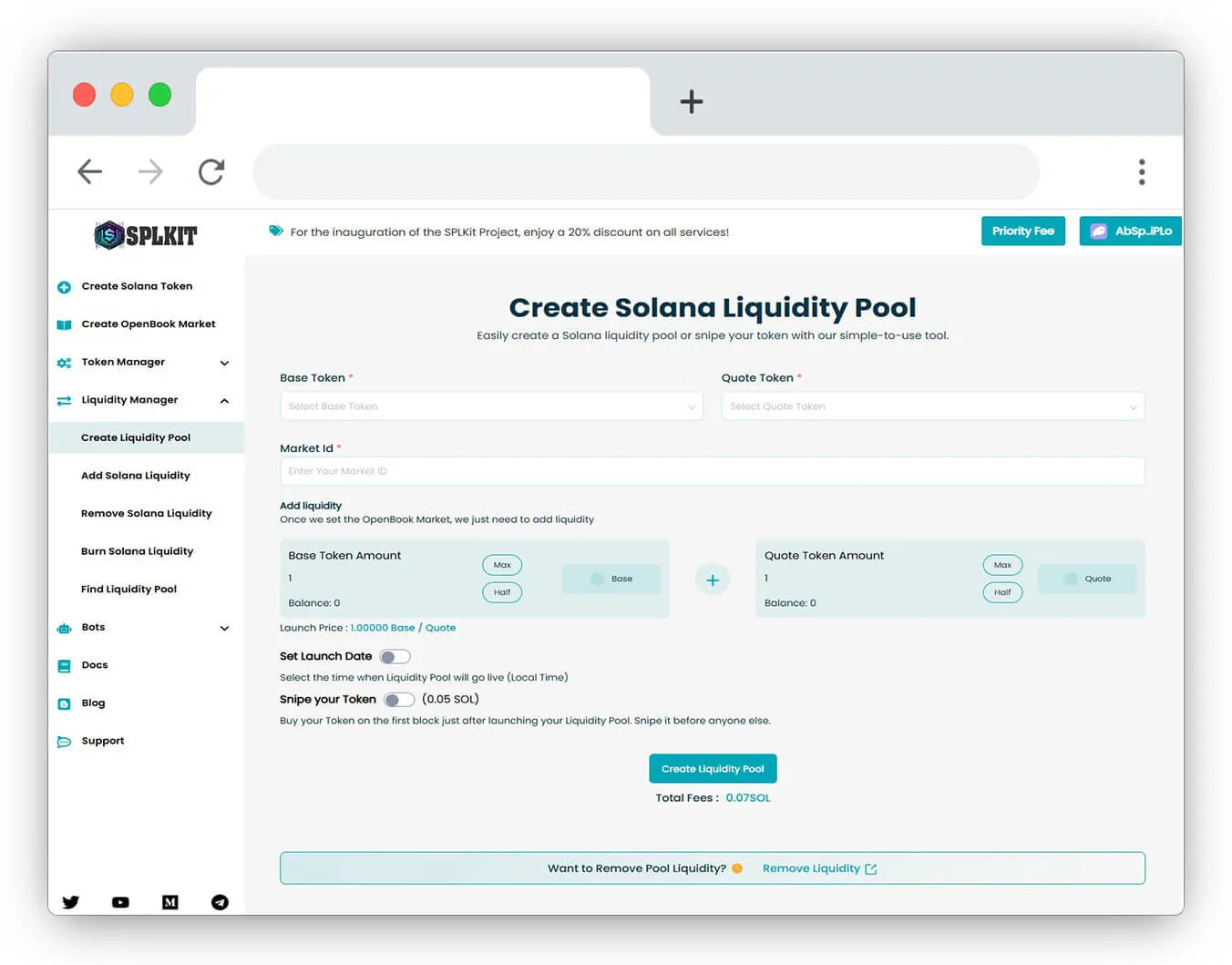

Create Solana Liquidity Pool Tools

Create Solana Liquidity Pool Tools

How to Create a Liquidity Pool on Solana

Follow these simple steps to create a liquidity pool on Solana:

-

Connect Your Solana Wallet

Start by linking your Solana wallet to the platform. This will allow you to execute transactions and manage your liquidity pool easily. -

Choose the Token Pair

Select the two tokens you want to include in your liquidity pool. The Quote Token (usually SOL or USDC) will help set the price of your Base Token (e.g., a token you have created). -

Define the Starting Price

Set the initial price for your Base Token within the liquidity pool. This price will determine the initial exchange rate between the Base Token and the Quote Token. -

Specify Minimum Token Quantity

Determine the minimum number of tokens users purchase or sell when interacting with your liquidity pool. This requirement ensures that only significant transactions are processed. -

Establish Minimum Price Change

Set the most minor allowable price change for the token pair in your pool. This can be specified in terms of SOL or USDC and helps maintain price stability within the pool. -

Decide on Liquidity Amount

Specify the total amount of liquidity you wish to contribute to the pool. This will help reduce slippage and improve the pool's trading capacity. -

Create the Solana Liquidity Pool

Once you have set all the parameters, click "Create Solana Liquidity Pool" and confirm the transaction. Your liquidity pool will be established on the Solana blockchain and ready for use.

Visual Guide

For a visual guide, check out our YouTube tutorial that explains the process of creating a liquidity pool on Solana.

When Should You Create a Solana Liquidity Pool?

-

Launching a New Token

Creating a liquidity pool is essential when launching a new token. It provides market access for buyers and sellers, ensuring your token can be easily traded. -

Supporting a Token Project

If you are involved in a token project, providing liquidity is crucial for maintaining stable trading conditions. This helps facilitate smooth transactions for your token. -

Optimizing a Trading Strategy

Advanced traders can set specific parameters in their liquidity pools to take advantage of price movements. This allows them to earn fees and adjust their liquidity based on changing market conditions.

FAQ: Creating a Solana Liquidity Pool

Q1. What is a Solana Liquidity Pool?

A Solana Liquidity Pool is a smart contract that holds pairs of tokens, allowing users to provide liquidity for trading on decentralized exchanges (DEXs). By contributing to these pools, users facilitate seamless transactions and earn transaction fees from trades.

Q2. What tokens can I use to create a liquidity pool?

You can use any compatible tokens on the Solana blockchain. Typically, one of the tokens is a stablecoin, such as USDC or SOL, which helps establish the price of your base token. The base token can be any token you wish to trade.

Q3. How does providing liquidity reduce slippage?

Providing liquidity reduces slippage by ensuring sufficient tokens are available for trading. Large trades can be executed with minimal price impact when a pool has adequate liquidity, resulting in a better trading experience for users.

Q4. Are there any costs associated with creating a liquidity pool?

Yes, there may be costs involved in creating a liquidity pool, such as transaction fees on the Solana blockchain. These fees can vary depending on network conditions and the specifics of your transaction.

Q5. How can I manage my liquidity pool after creation?

After creating your liquidity pool, you can monitor its performance, adjust liquidity parameters, and manage your token holdings through your Solana wallet. You can also withdraw your liquidity or reconfigure the pool settings based on your trading strategy.

Q6. Can I create a liquidity pool for a newly launched token?

Creating a liquidity pool for a newly launched token is essential as it provides market access for buyers and sellers. This facilitates trading and helps establish the token's market price.

Conclusion

The Creating Solana Liquidity Pool feature provides the tools to actively engage in Solana's decentralized finance ecosystem. By setting up a customized pool, you can contribute to market stability, earn fees, and manage liquidity effectively. Whether launching a new token or optimizing your trading strategy, this feature allows you to control your liquidity, ensuring you maximize your DeFi experience.